Calculating return on investment over multiple years

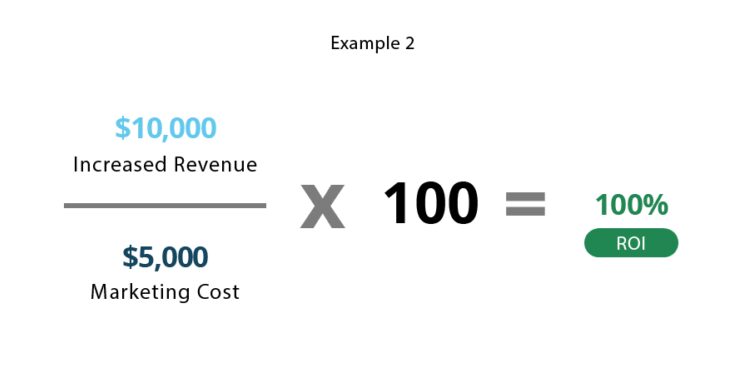

ROI net profit total investment x 100. Whatever Your Investing Goals Are We Have the Tools to Get You Started.

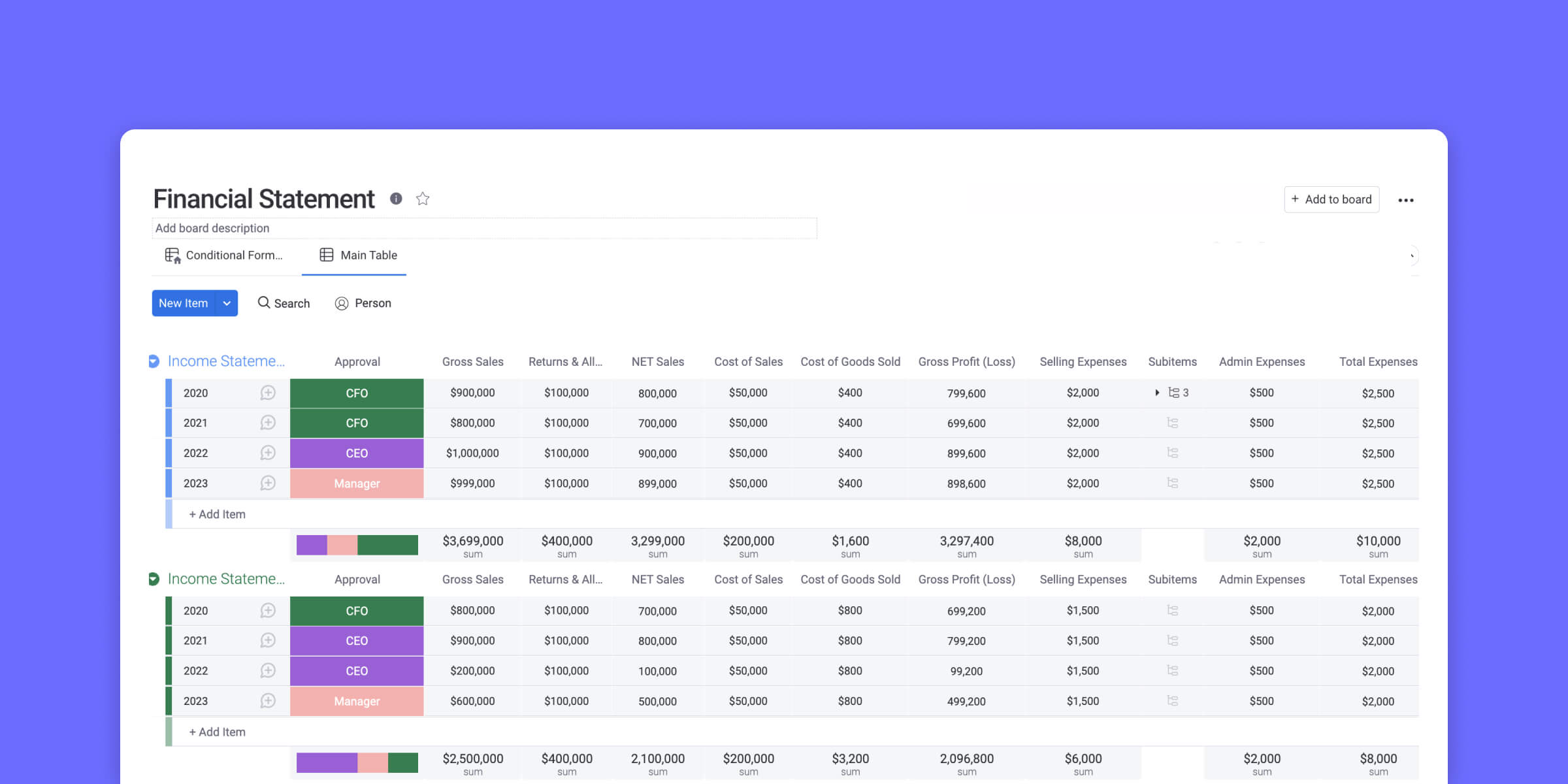

How Do You Use The Roi Formula On Excel Monday Com Blog

ROI Net gain on investment dividends - fees Initial cost of investment The first step is to take the total gain for the year and subtract the initial investment amount.

. From novice to expert these are the brokers for you. Ending value - beginning value. The formula goes like this.

ReTherefore 1x 3 1 20. Average annual return on stocks. Last multiply by 100.

Ad Build Your Future With a Firm that has 85 Years of Investment Experience. T 3 years. By dividing your total return over your beginning value we arrive at holding period return which is.

So if you buy 50 shares of stock at 20 per share you. Return on investment ROI is a metric used to assess the performance of a particular investmentROI is expressed as a percentage and can. Ad Your Investments Done Your Way.

You should use an annualized rate of return to calculate how much you will earn on a yearly basis over the number of years that the investment is outstanding for. The ROI is calculated by dividing the actual profit by the total investment amount and multiplying the result by 100. Youll need to use the exponent key on your calculator.

Ad Your Investments Done Your Way. The Free Calculator Helps You Sort Through Various Factors To Determine Your Bottom Line. For Investment A with a return of 20 over a three-year time span the annualized return is.

Ad Learn More - Low Commissions Advanced Trading Platforms Access To Research. To calculate the total return rate which is needed to calculate the annualized return the investor will perform the following formula. The resulting number is the percentage by which profit increased or.

ROI multiple periods cumulative return over all periods r return per period in the equation needs to be solved for r t number of periods The first component of this formula is. How to calculate earnings and Roi. Unique Tools to Help You Invest Your Way.

The sum of your capital appreciation and income return is yourtotal return. Exploring an Example For example if you invested 2400 and ten years later. A good place to start is looking at the past decade of returns on some of the most common investments.

The net profit equals the difference between the net benefit and the net cost related to making the investment. Ad TD Ameritrade Investor Education Offers Immersive Curriculum Videos and More. Our top picks for online brokers.

The total investment is the sum one. You can calculate the ROI on a given investment by dividing your net income by your initial costs and multiplying by 100. Unique Tools to Help You Invest Your Way.

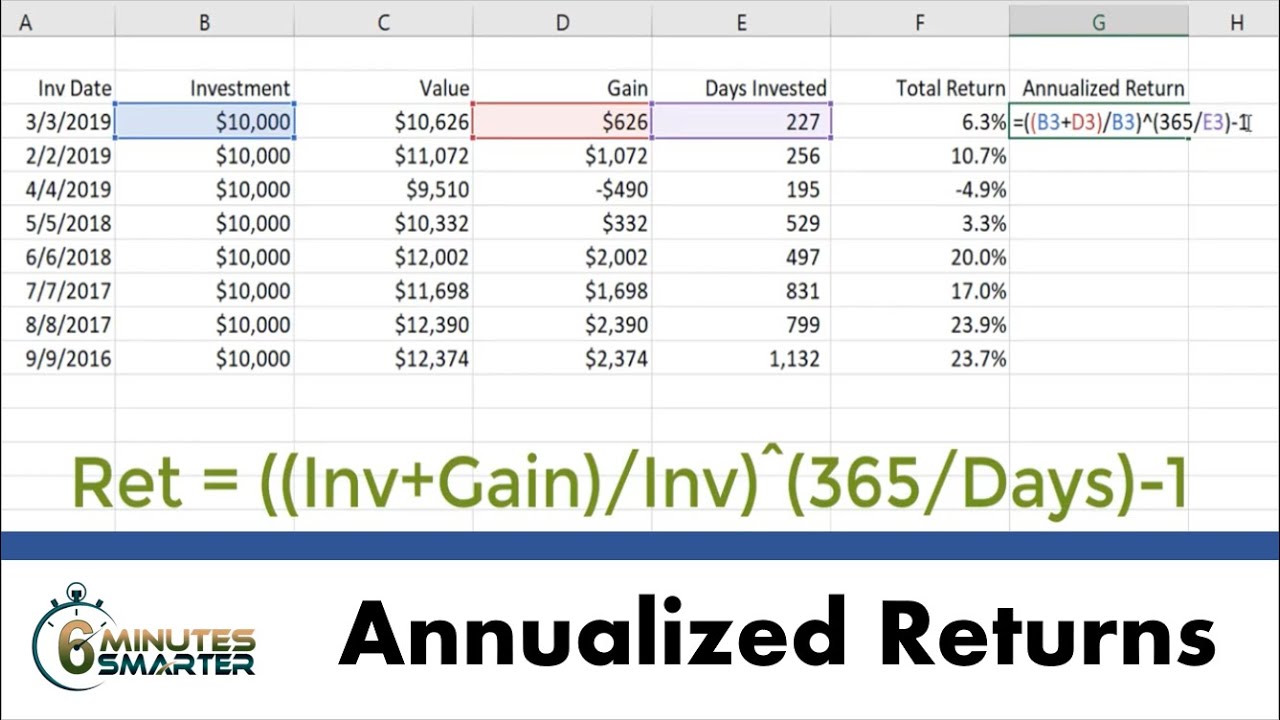

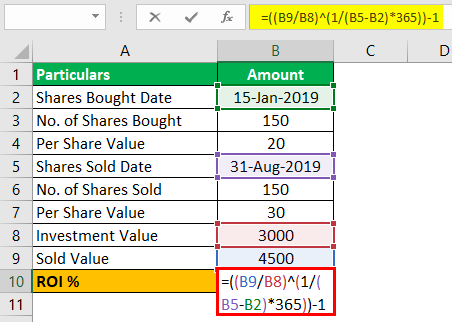

Solving for x gives us an. Ad Meeting Your Long-Term Investment Goals Is Dependent on a Number of Factors. Annualized ROI Selling Value Investment Value 1 Number of Years 1 The number of Years will be calculated by taking into consideration Investment Date deducted.

Calculate Annualized Returns For Investments In Excel Youtube

.jpg)

Return On Investment Roi Formula Meaning Investinganswers

Calculating Investment Return In Excel Step By Step Examples

Calculating Return On Investment Roi In Excel

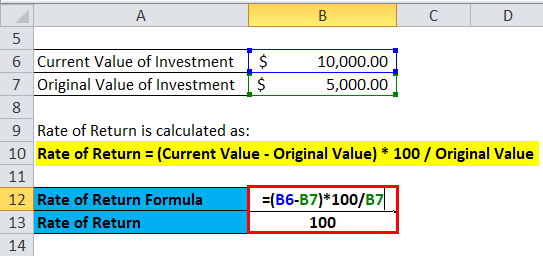

Rate Of Return Formula Calculator Excel Template

Return On Investment Roi Formula Meaning Investinganswers

Return On Investment Roi Definition Equation How To Calculate It

Return On Investment Roi Definition Equation How To Calculate It

How To Calculate The Return On Investment Roi Of Real Estate Stocks Youtube

Return On Investment Roi Formula And Calculator Excel Template

How To Prove And Improve Your Social Media Roi Free Calculator

Internal Rate Of Return Irr Formula And Calculator

How Do You Use The Roi Formula On Excel Monday Com Blog

Calculating Return On Investment Roi In Excel

Calculating Return On Investment Roi In Excel

Roi Calculator Formula The Online Advertising Guide Ad Calculators

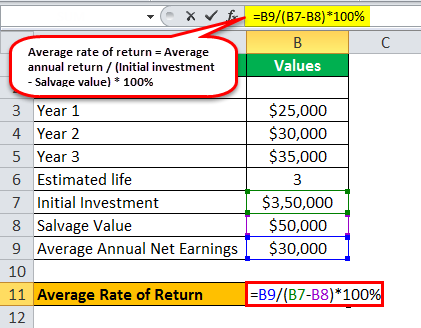

Average Rate Of Return Definition Formula How To Calculate